Core Scientific Posts 11% Decline in Q3 Revenue Amid Market Share Erosion

Bitcoin mining and colocation provider Core Scientific recorded an 11% decline in Q3 revenue compared to Q2 despite bitcoin’s average prices remaining at $28,000 during both quarters.

In a Q3 filing on Monday, Core Scientific reported a total revenue of $112.9 million from its proprietary mining and hosting segments, down from $126.9 million in the previous quarter. It’s worth noting that Q3’s revenue was even lower than those of Q4’22 and Q1’23, when bitcoin’s average prices were around $20,000.

Meanwhile, operating expenses, including the cost of revenue (COGS), selling, general and administration (SG&A) but excluding depreciation and share-based compensation, experienced a slight increase to over $86.7 million in Q3. However, these expenses remained significantly lower compared to the figures in 2022.

The decrease in Core’s self-mining production capacity, driven by increased competition in the network, was the primary factor behind the decline in total revenue.

Due to its ongoing Chapter 11 bankruptcy proceeding, Core has been unable to expand its proprietary mining capacity. In contrast, companies like Marathon, Riot, and CleanSpark have continued to add more equipment in anticipation of the upcoming halving. In August, Marathon officially took over Core Scientific’s position as the largest public bitcoin mining firm by hashrate capacity.

As a result, while Core’s hosting segment consistently contributed approximately $30 million to quarterly revenue, the self-mining revenue decreased from $97 million in Q2 to $83 million in Q3.

Below is a gross margin breakdown for Core’s self-mining and hosting businesses, considering only cash-based COGS in each segment and excluding SG&A expenses. The projected gross margin for Q4 and beyond is based on Core’s latest estimate as part of its Chapter 11 reorganization plan.

In a recent statement, Core said it intends to exit the Chapter 11 proceedings by year-end to expedite its growth plans related to infrastructure and mining equipment. The company purchased 27,000 S19XPs from Bitmain using a combination of cash and share-based payments.

However, the optimistic projection for self-mining gross margin in 2024, following the halving, appears to hinge largely on the assumption of a significant increase in bitcoin’s hashprice.

Bitcoin mining site image via Core Scientific

RELATED ARTICLES

MORE NEWS

MARA Sues to Block Texas County Vote Creating Town Around Its Bitcoin Mine

Nov 3, 2025

Miner Weekly: Bitcoin Mining Debt Set for New Records — But This Time It’s Different

Oct 16, 2025

MARA Sells Half of Mined Bitcoin for First Time in Over a Year as Uptime Improves

Oct 4, 2025

MARA to Acquire Majority Stake in EDF’s HPC Subsidiary Exaion for $168 Million

Aug 11, 2025

MARA, Riot Diverge on Bitcoin Mining Financing in Q2

Aug 5, 2025

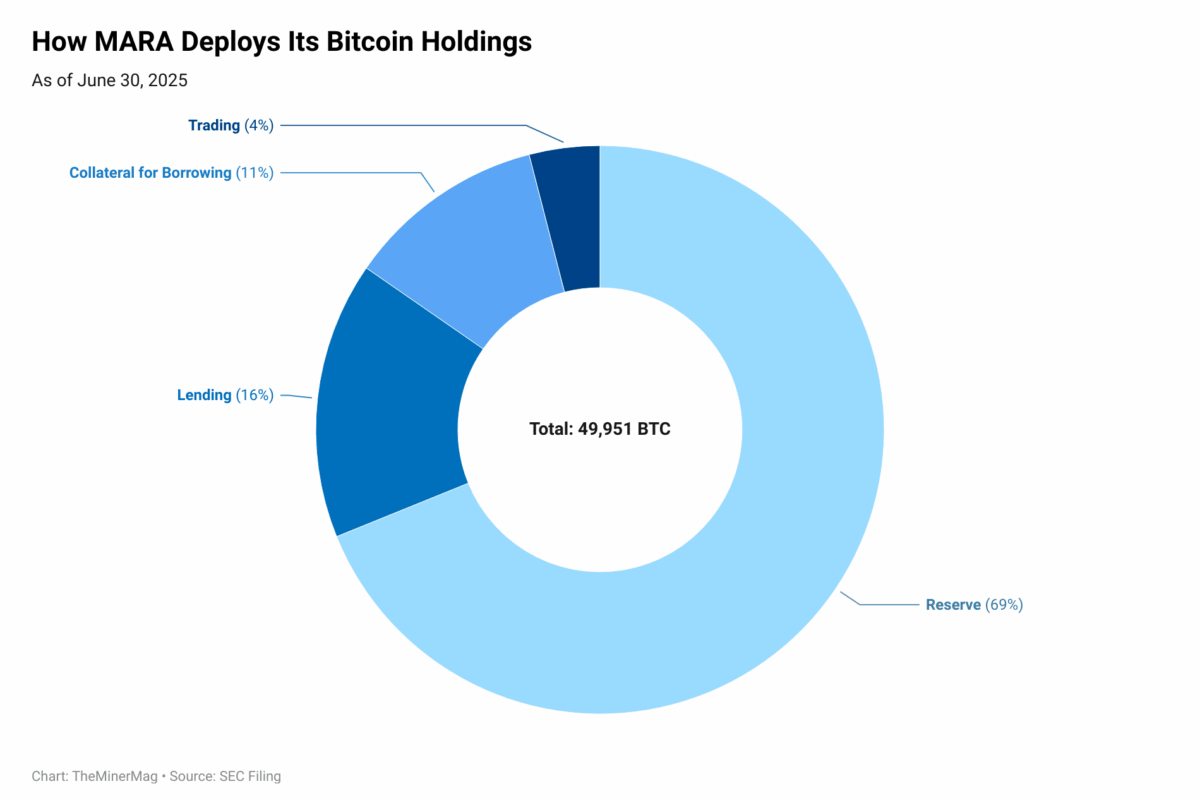

Miner Weekly: MARA’s Bitcoin Deployment Implies Up to 6.5% Annualized Yield – For Now

Jul 31, 2025