Bitcoin Mining Stocks Hit Record $58B Market Capitalization in September

The combined market capitalization of major publicly traded bitcoin miners reached an all-time high of $58.1 billion in September, extending a sharp recovery after a spring selloff tied to U.S. import tariffs.

The aggregate valuations of 15 major mining stocks rose from $41.6 billion in August to $58.1 billion in September, more than doubling from a Q2 low of $19.9 billion in March, according to monthly figures.

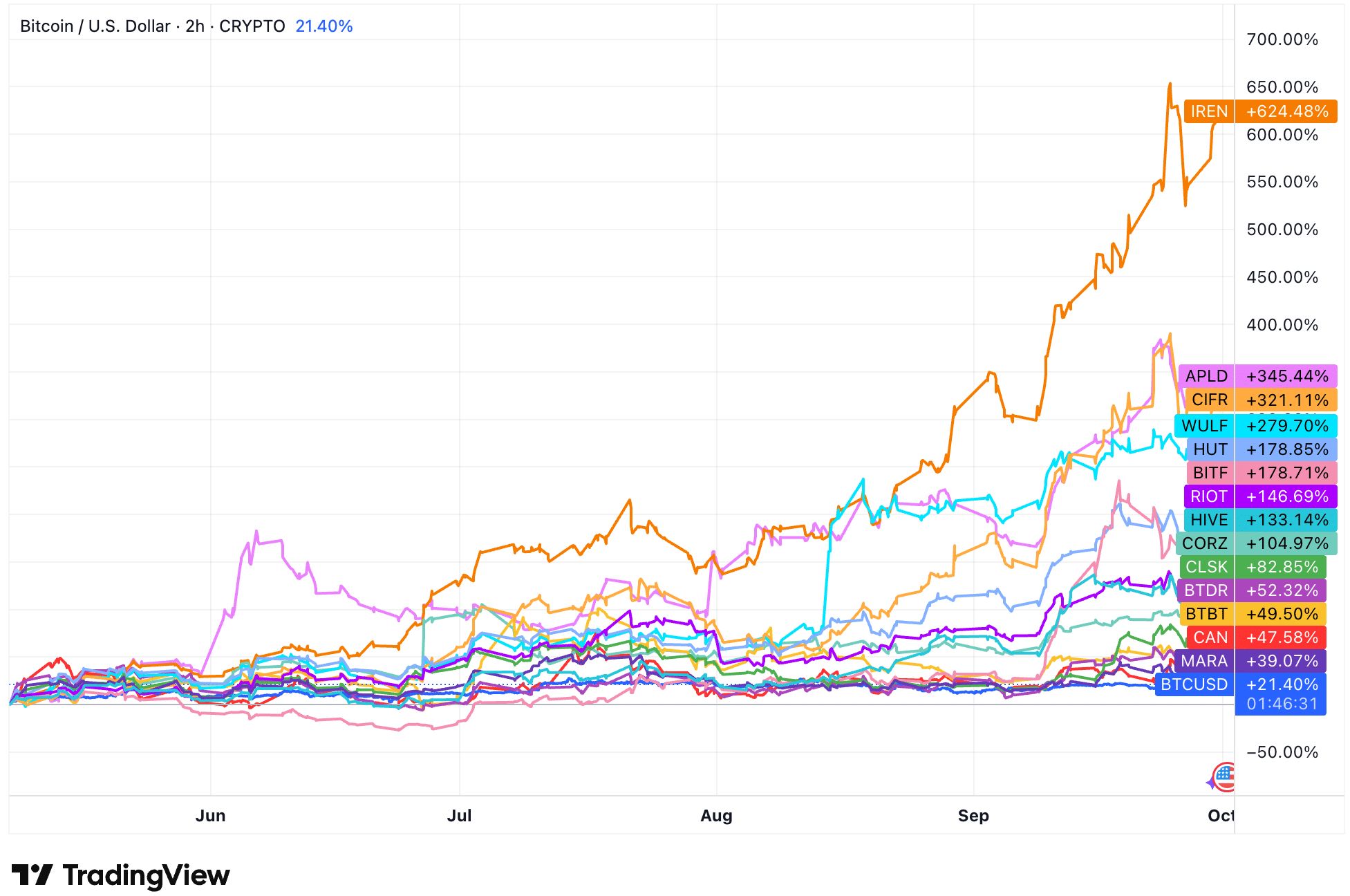

The rally in equities far outpaced the performance of bitcoin itself. Over the past six months, bitcoin gained 21%, compared to triple- and even quadruple-digit rebounds among miners.

Australia-based IREN led with a 624% surge while Cipher Mining (CIFR) and Applied Digital (APLD) also soared, up 321% and 345%, respectively, on high-performance computing momentum.

Other miners, including TeraWulf (WULF), Hut 8 (HUT), and Bitfarms (BITF) more than doubled in value, rising between 179% and 280% since the spring lows. Riot Platforms (RIOT) advanced nearly 147%, while HIVE gained 133% and Core Scientific (CORZ) climbed 105%.

Even the larger names such as CleanSpark (CLSK), Bitdeer (BTDR) and MARA, posted double-digit returns well above bitcoin’s performance.

The surge capped a strong third quarter for the sector, with miners entering October on continued momentum. Bitcoin itself began the month on a bullish note, rebounding to $116,000 on the first day of October in what traders dubbed the latest “Uptober” rally.

RELATED ARTICLES

MORE NEWS

Cipher Seeks $2B in New Secured Notes to Fund AI Data Center Build in Texas

Feb 3, 2026

Cipher Appoints Lee Bratcher, Drew Armstrong to Lead Policy and HPC Strategy

Jan 6, 2026

Cipher Enters PJM With 200 MW Ohio Site Aimed at HPC Workloads

Dec 23, 2025

Fluidstack Seeks $700M at $7B Valuation as AI Data Center Boom Accelerates

Dec 7, 2025

Cipher to Raise $333 Million More for Barber Lake Build-Out Amid Fluidstack HPC Expansion

Nov 20, 2025

Cipher Plans $1.4B Debt Offering to Fund Texas HPC Data Center Following AWS Deal

Nov 4, 2025