Bitcoin Mining Stocks Double in Value to $90 Billion as Sector Extends Rally

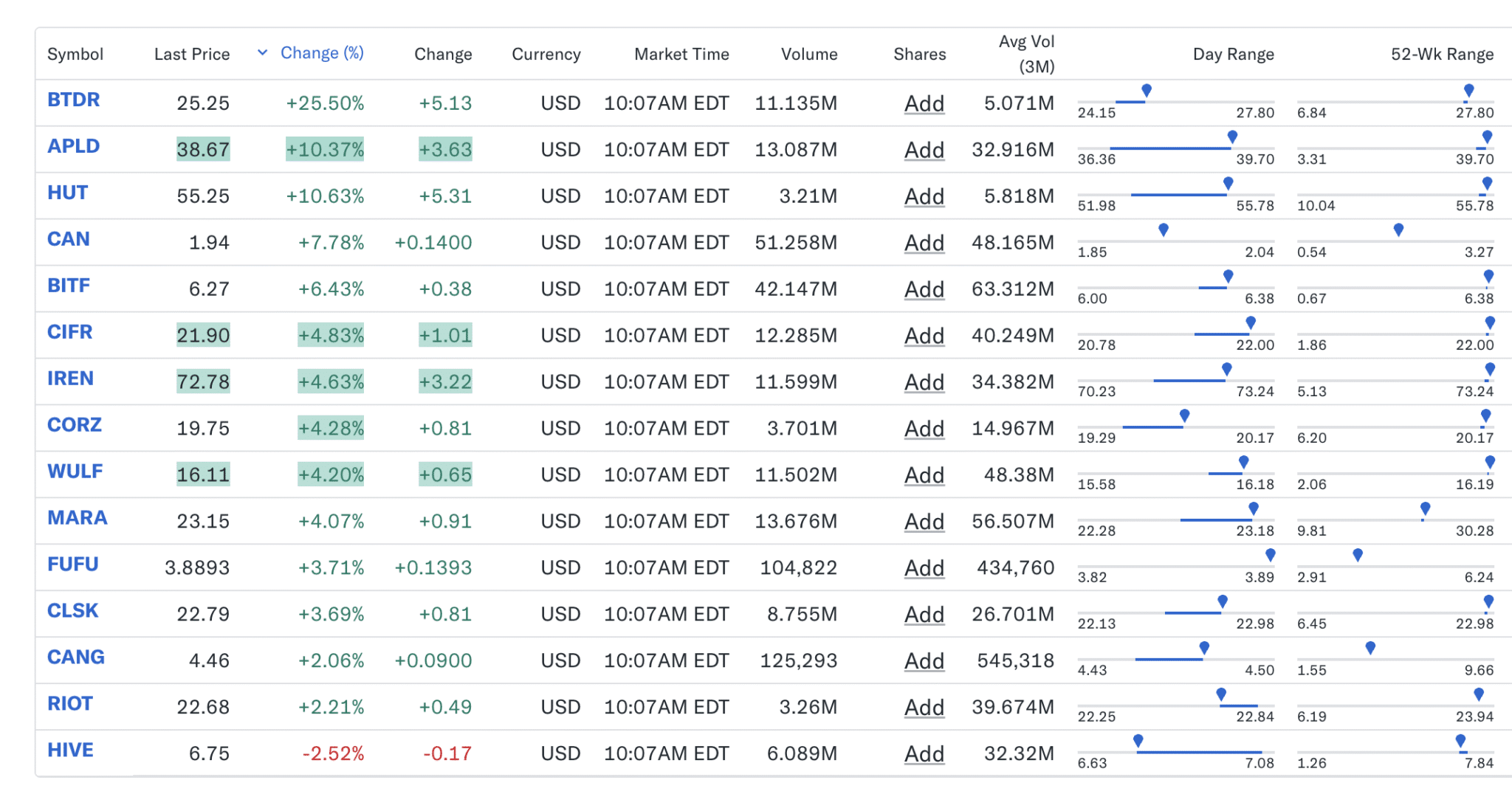

Bitcoin mining stocks continued their strong rebound on Wednesday, pushing the combined market capitalization of 15 major publicly listed miners to over $90 billion—more than double the level recorded less than two months ago.

The rally was led by Bitdeer, whose shares jumped as much as 32% to $26.61, marking their highest level in over a year. The Singapore-headquartered company on Tuesday disclosed a 32.9% increase in realized hashrate in September via the energization of its proprietary mining rigs, overtaking Riot as the world’s fifth-largest public Bitcoin miner.

Canaan, another mining hardware maker and operator of its own mining fleet, gained as much as 11.1% to $2.00. The company recently secured a 50,000-unit order for its A15 Pro Avalon miners and expanded its pilot gas-to-power mining project in Canada.

The momentum extended across nearly the entire sector. Applied Digital and Hut 8 also posted double-digit gains on Wednesday, while almost every other company is approaching or has set new 52-week highs.

The sharp rise in valuations reflects renewed investor confidence in vertically integrated miners that combine ASIC design, self-mining, and AI infrastructure capacity.

It also highlights the broader shift in market sentiment toward digital infrastructure operators, even as hashprice remains under pressure near $47/PH/s due to record network difficulty and a softening bitcoin price.

RELATED ARTICLES

MORE NEWS

Bitdeer Challenges MARA for Top Spot After December Bitcoin Production Jump

Jan 13, 2026

Bitdeer Leases Nevada Facility to Scale US Bitcoin Miner Production

Dec 22, 2025

Bitdeer Lifts November Bitcoin Output as Mining Sites Begin AI Data Center Conversions

Dec 15, 2025

Bitdeer Shares Drop 22% After Pricing $400M Convertible Notes and $149M Equity Offering

Nov 13, 2025

Fire Put Out at Bitdeer’s Under-Construction Bitcoin Mine in Ohio, No Injuries Reported

Nov 12, 2025