Situational Awareness Raises Core Scientific Stake to 9.4% Ahead of CoreWeave Merger Vote

Situational Awareness, the fast-growing AI hedge fund founded by former OpenAI researcher Leopold Aschenbrenner, has increased its stake in bitcoin miner Core Scientific (NASDAQ: CORZ) to 9.4%.

According to a Schedule 13D filed Tuesday with the SEC, the hedge fund continued to buy Core shares aggressively through mid-October, adding more than 10 million shares since September at prices ranging mostly between $17 and $19 per share. Its latest purchase on Oct. 14 involved 2.3 million shares at $19.07 each, lifting its total ownership from 5.8% previously to 9.4%.

The position build-up comes just weeks before Core Scientific’s shareholders are set to vote on the company’s proposed merger on Oct. 30 with AI cloud operator CoreWeave, a deal that would give CoreWeave a controlling stake in the mining company and further accelerate its pivot toward high-performance computing services.

Founded last year, Situational Awareness has drawn attention on Wall Street for its unconventional approach and its rapid ascent. As Fortune reported this month, Aschenbrenner—who was previously a member of OpenAI’s superalignment team and worked for FTX’s philanthropy arm—launched the fund with Silicon Valley backers, despite the founder’s young age.

Other bitcoin mining-related stocks that the hedge fund owns include $93 million in IREN and $63 million in Applied Digital, according to the Fortune article.

RELATED ARTICLES

MORE NEWS

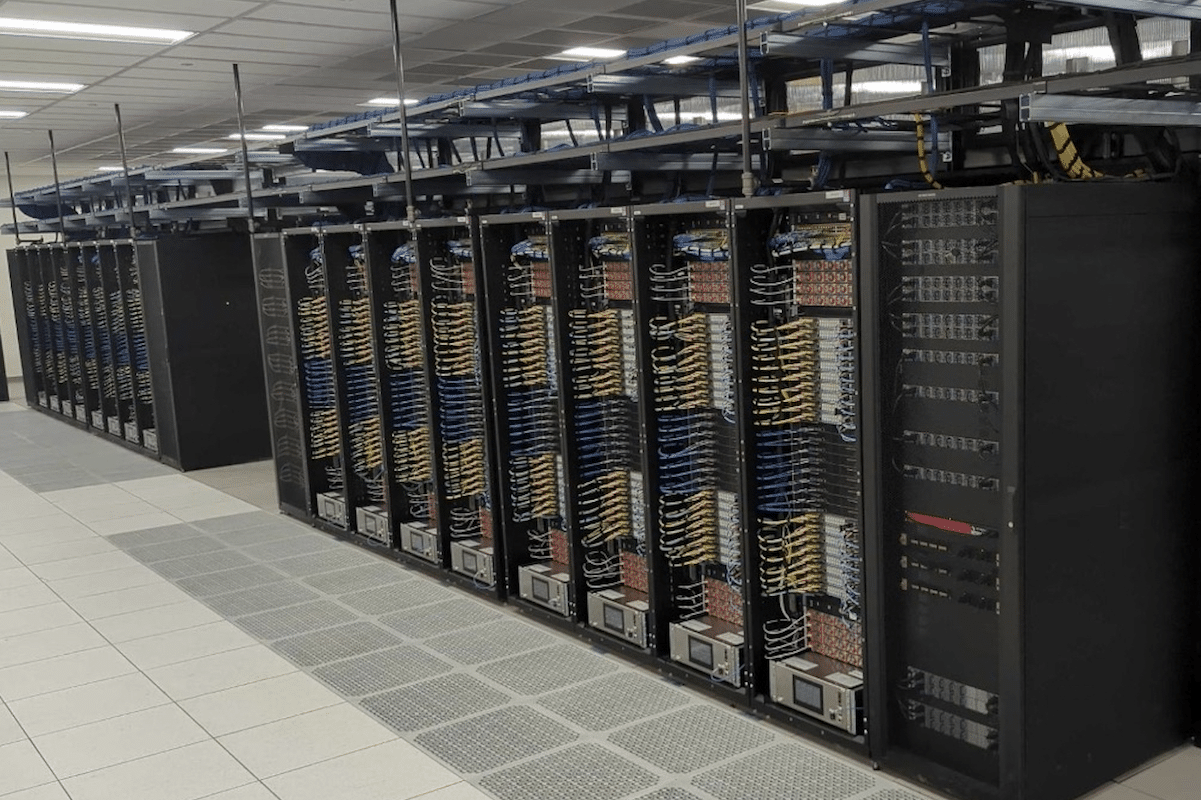

CoreWeave Deploys 16,000 GPUs at Delayed Texas Data Center for OpenAI

Jan 14, 2026

Weather Disruptions Delay CoreWeave, Core Scientific AI Data Center in Texas: Report

Dec 16, 2025

Citadel Discloses 5.5% Stake in Core Scientific, Adding to Recent Bitcoin Mining, AI Positions

Dec 11, 2025

Pentwater Discloses $400M Core Scientific Position Following Failed CoreWeave Deal

Nov 18, 2025

Core Scientific Sets October 30 Shareholder Vote on CoreWeave Merger

Sep 29, 2025