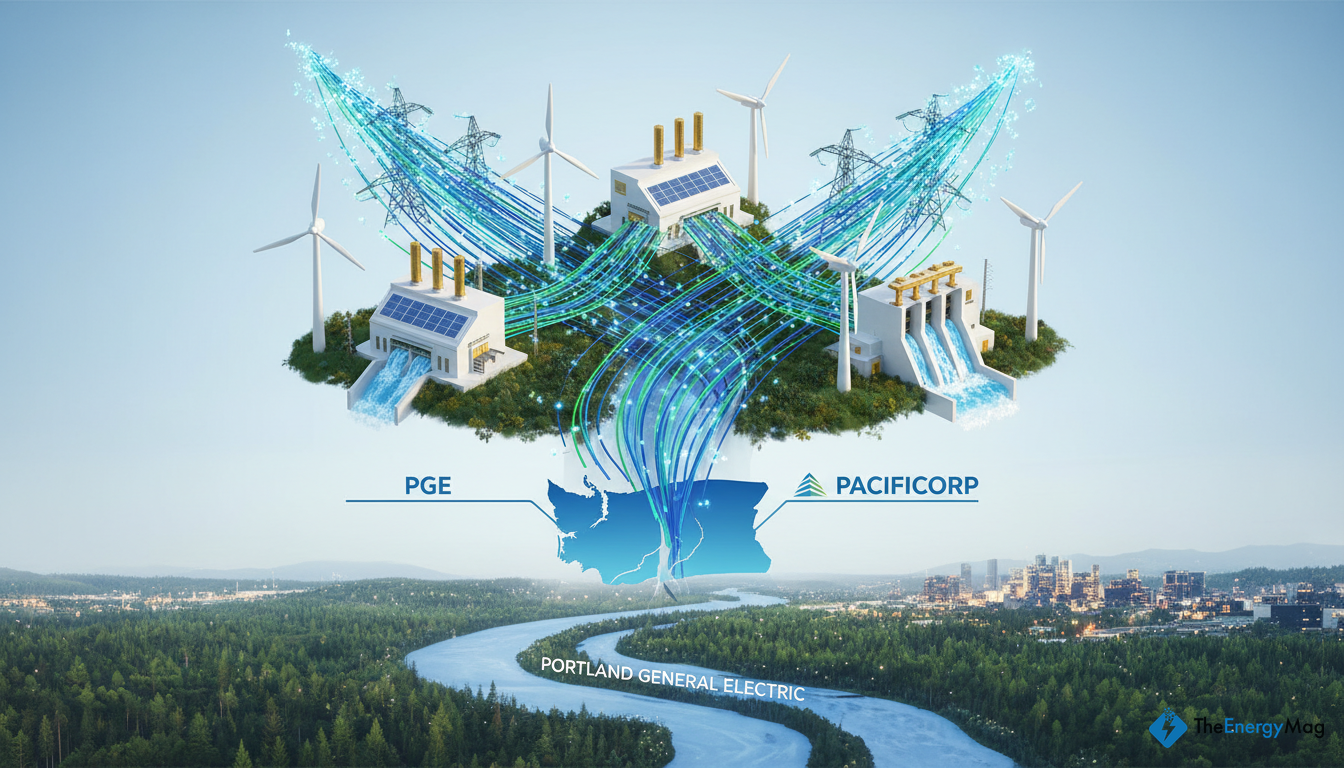

Portland General Electric Acquires Washington Utility Operations from PacifiCorp

AI-generated image: synthetic visual, not an actual depiction of events, people, or locations.

On February 17, 2026, Portland General Electric Company (PGE) announced its agreement to acquire select generation, transmission, and electric utility operations from PacifiCorp for $1.9 billion. This acquisition is significant as it represents a purchase price multiple of 1.4 times the estimated 2026 rate base, indicating a strategic investment aimed at expanding PGE's operational capabilities and customer base in Washington state.

The acquisition encompasses three generation facilities: the Chehalis natural-gas plant with a capacity of 477 MW, the Goodnoe Hills wind facility at 94 MW, and the Marengo I and II wind facilities totaling 234 MW. Additionally, PGE will gain control over 4,500 miles of transmission and distribution lines, which will enhance its infrastructure and operational efficiency across a service area of approximately 2,700 square miles.

This strategic move is expected to allow PGE to extend its commitments to reliability, affordability, and economic development to around 140,000 new customers in Washington. The company anticipates that the acquisition will be accretive in the first full year following the closing, contributing positively to PGE's long-term earnings per share (EPS) and dividend growth.

Maria Pope, PGE's President and CEO, expressed enthusiasm about the acquisition, highlighting the opportunity to grow and build upon PGE's foundation of operational excellence and customer service. The partnership with Manulife Investment Management, which will hold a minority stake in the Washington utility business, is also noteworthy. Manulife's extensive experience in infrastructure investment in the Pacific Northwest is expected to bolster PGE's operational capabilities.

The acquisition will be managed as a separate entity under a newly formed subsidiary regulated by the Washington Utilities and Transportation Commission. PGE expects the regulatory review process to take approximately 12 months following the submission of necessary filings. This regulatory oversight is crucial as it will determine the feasibility and timeline for the integration of the acquired assets into PGE's existing operations.

From a financial perspective, PGE reported a net income of $306 million for the year ended December 31, 2025, reflecting a slight increase from the previous year. The company has also reaffirmed its long-term earnings growth target of 5% to 7%, with adjusted earnings guidance for 2026 set between $3.33 and $3.53 per diluted share. This financial stability positions PGE well to absorb the costs associated with the acquisition and to invest in further growth initiatives.

The acquisition aligns with PGE's ongoing strategy to meet the growing demand for electricity, particularly from data centers and high-tech customers, which have driven a compounded annual growth rate of 10% in industrial demand from 2020 to 2025. As PGE continues to expand its service offerings and infrastructure, the integration of these new assets will be critical in maintaining service reliability and meeting future energy demands.

Looking ahead, stakeholders should monitor the regulatory approval process closely, as any delays or challenges could impact the timeline for the acquisition's completion. Additionally, the performance of the acquired facilities and their integration into PGE's operational framework will be key indicators of the success of this strategic move. The company's ability to leverage its new assets to enhance service delivery and customer satisfaction will also be critical in maintaining its competitive edge in the energy market.

This article was generated with the support of our AI agent, which has been rigorously trained under the supervision of well-qualified journalists. While we strive for the highest quality in every article, if you find anything amiss, please contact us to let us know.