Activist Starboard Pushes Riot to Speed Up Shift From Bitcoin Mining to AI Data Centers

Activist investor Starboard Value is reportedly urging Riot Platforms (NASDAQ: RIOT) to move faster in repositioning itself from a pure-play Bitcoin miner into a data center operator catering to large cloud and AI customers.

In a letter reviewed and reported by Bloomberg on Tuesday, the activist investor said it may publicly spell out its views as soon as Wednesday. Starboard has been an active presence at Riot, having supported board changes last year, and it ranked as the company’s fourth-largest shareholder at the end of 2025. The letter was signed by Starboard managing member Peter Feld, Bloomberg said in the report.

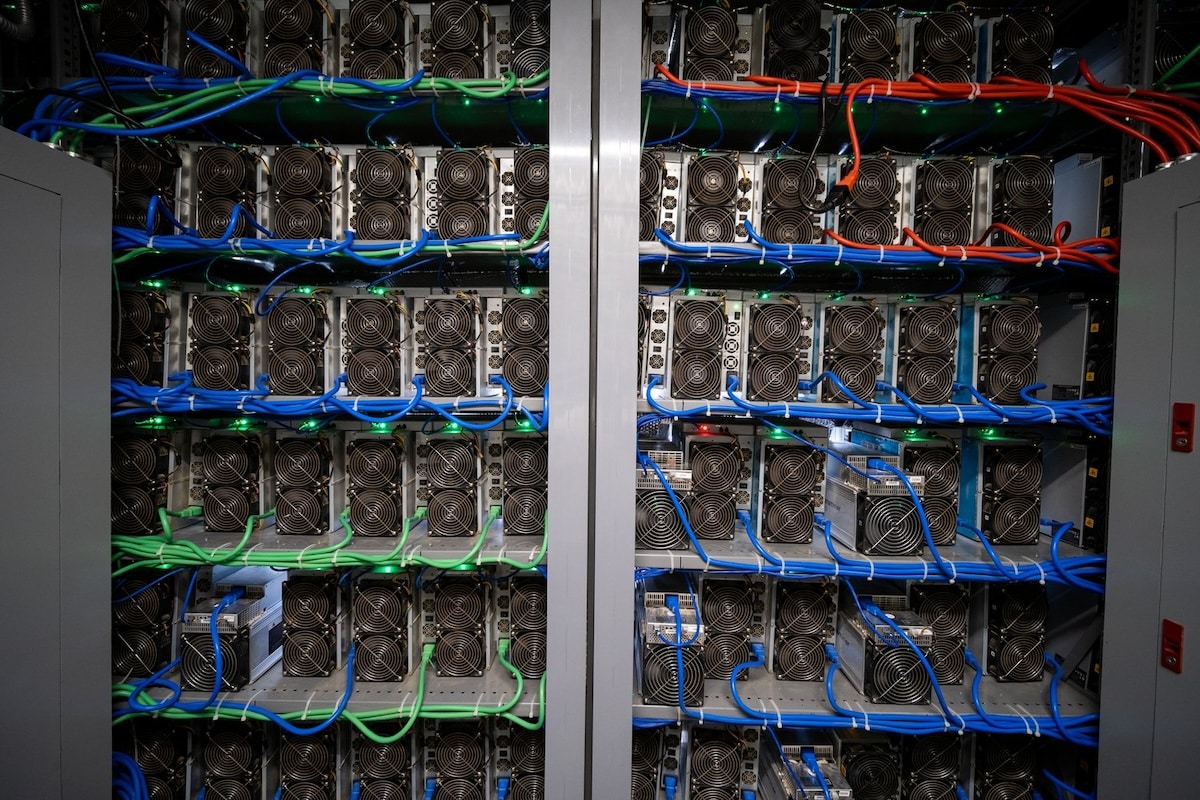

Riot, one of the biggest U.S.-listed Bitcoin miners with a market capitalization of around $6 billion, runs two large-scale sites in Texas. Starboard pointed to Riot’s Corsicana and Rockdale campuses as prime locations for AI and high-performance computing deployments, arguing that the two sites together offer roughly 1.7 gigawatts of available power. Feld wrote that the company should act quickly to capture what Starboard sees as an unusually strong market opportunity.

The investor’s push comes as miners increasingly look to repurpose power contracts and industrial footprints for AI and HPC, a shift that has gained momentum as mining economics have come under pressure amid crypto price weakness and periods of higher power costs tied to extreme weather, according to Bloomberg.

Bloomberg also cited Riot CEO Jason Les as saying last summer that data center leasing can carry better economics and command higher valuation multiples than Bitcoin mining, though he cautioned that the speed of any transition would depend on customer demand, financing conditions and the broader data center market.

Meanwhile, Riot’s rivals such as Cipher and Terawulf have drawn high-profile backers for AI-related data center efforts, helping unlock large revenue projections and additional financing options.

Starboard estimated that if Riot can monetize its power portfolio on terms comparable to recent deals in the sector, the company could produce more than $1.6 billion a year in EBITDA. The activist added that Riot’s assets could also make it attractive in a consolidation scenario.